Maintain the status of the "big bang" of start-ups

For the end user, IoT may be slow, but the IoT start-up ecosystem is rapidly emerging. This is a very broad market – there are many things that are the same, but there are some differences. However, we are seeing a lot of new companies emerging, and young start-ups are starting to rise.

In early 2016, startups in the IoT space have been active for 3-4 years. Incubators (including hardware-related and full-stack companies like Y Combinator and Techstars) have spawned many startups. Crowdfunding provides early funding. Many contract manufacturers in China have started to cooperate with and invest in startups. Service providers like Dragon InnovaTIon are also investing.

Although Silicon Valley is still cultivating many companies with ideas, IoT companies are a broader and more global phenomenon. Most of the top 100 in Mattermak's IoT rankings are outside the Bay Area. In the 2016 IoT map, more than 150 companies are located outside the United States. In the 2016 CES, 160 French startups participated. Of course, China has a production base for the entire hardware. In addition, many female CEOs have emerged in hardware companies.

Venture capital in the IoT sector continues to increase: according to CB Insights, $1.8 billion in 2013, $2.59 billion in 2014, and $3.44 billion in 2015. The number of contracts has decreased - 307 in 2013, 380 in 2014, and 322 in 2015. This shows that more and more money is flowing to more mature companies. A few of the companies were still in the B round of financing 18 months ago. But since we were in the last page, this has changed significantly. Examples include Sigfox (D1,115 million in February 2015), 3D RoboTIcs (50 million in February 2015), Peloton (30 million in April 2015), Canary (June 2015) Round 30 million), Netatmo (3 million in round B in November 2015), Athos (35 million in round C in November 2015), Greenwave (45 million in round C in January 2016), Jawbone (2015 1 Monthly E+ round 165 million), FreedomPop (10 million in January 2016), Razer (75 million in February 2016) and Ring (6.1 million in March 2015).

However, for most VCs, hardware is just an attempt. The 2015 Fitbit IPO effectively demonstrates that IoT startups can also be successful and provide good financial data. However, traditional venture capital still looks at hardware start-ups with suspicion, and IoT's investment is also an attempt. Today's hardware startups are no longer in desperate need of large amounts of money, but I have observed that a hardware startup in the US still needs $10 million in financing to get on track.

Fortunately, strategic investors and corporate investors have begun to enter on a large scale. According to CB Insights, the two most active corporate investors are Intel Capital and Qualcomm Ventures. Cisco also appears in the top 10 of traditional VC investments. Verizon Ventures, GE Ventures, Comcast Ventures and Samsung Ventures are also active. Netatmo's Series B financing was initiated by Legrand, while Sigfox's Series D financing was initiated by Telefonica and other communications companies. Asian investors are also starting to get active – for example, Foxconn and Singapore's EDBI are starting to invest.

If the US venture capital market continues to be sluggish, its impact on the IoT ecosystem will be significant. When the market is difficult, the emerging areas are most likely to be affected, and corporate and foreign investors will become less active during this time. But maybe start-ups won't encounter this situation.

Now, as the start-up phase has passed and the funds are sufficient, we cannot accept that all new IoT startups will appear on the market at the same time. Areas like the consumer IoT market have been overcrowded, increasing failures and restructuring. IoT's corporate and industrial sectors are becoming more open, but many of the existing ones have been in operation for decades.

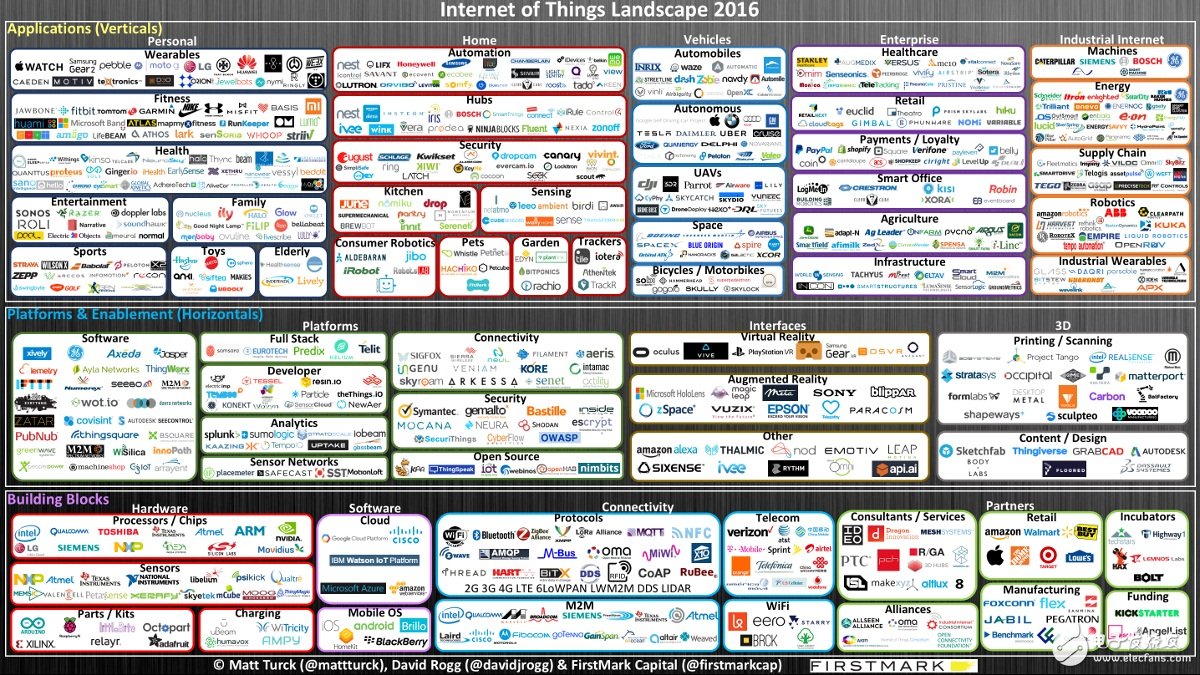

Here is our 2016 map:

(Click for larger image)

See the link for a full-size layout and a complete list of companies.

As in the previous version, the chart was divided into different sections: horizontal and vertical. Every area can see a lot of activities, but it is worth mentioning that the content has not been well integrated, and some vertical applications are not based on the horizontal areas below. However, we have paid special attention to full-stack IoT startups—because there are no dominant horizontal platforms, mature/cheap/reliable components, startups tend to build a lot of things themselves: hardware, software, data/analytics, and more. In addition, because many consumers are still in the stage of understanding IoT, enterprise-class IoT companies such as Helium also have a professional service organization. This is a typical start-up company in the early market, and we expect many of these companies to slowly change and be able to completely abandon the hardware in their business in the future.

Dancing with giants

In order to better understand the IoT ecosystem, it is important to realize that large companies are everywhere. Just look at the 2016 IoT map and you'll see that big companies are almost in every category.

In the era of Internet development (90s and 00s), dynamics will also emerge, but simple and rude—on the one hand, there are saboteurs; on the other hand, there are saboteurs. In the era of IoT, things have become more complicated – some startups in the Internet age have grown into big companies, and it is hard to predict who will “tearâ€.

Big technology and communications companies have been involved in the IoT. They believe that the era of IoT will surely come in the coming years. In some cases, the declaration is likely to precede the reality, but the trend is already obvious. Chip makers such as Intel, Qualcomm and ARM are fiercely competing for the IoT chip market. Cisco also began to focus on IoT and spent $1.4 billion to acquire startup Jasper. IBM also announced an investment of 3 billion for the new IoT business unit. AT&T has entered into a partnership with eight of the top ten automakers in the United States. Many communication companies also regard 5G networks as the backbone of IoT. Apple, Microsoft and Samsung have been actively involved and offer platforms (Apple's Homekit, Samsung's SmartThings, Microsoft's Azure IoT) and end products (Apple Watch, Samsung's Gear VR and Microsoft's HoloLens AR helmet). Salesforce also released the IoT cloud a few months ago. This list is still growing.

Alphabet/Google and Amazon may need to be introduced separately, considering their potential impact. From Nets, SideWalk Lab, unmanned vehicles to Google Cloud, Alphabet covers many aspects of the ecosystem. Amazon's AWS continues to innovate, releasing many new products, including the new IoT platform, and its e-business model is also important for IoT product launches. In addition, Echo/Alexa has also had a big impact on the smart home industry. These two companies are growing at the speed of startups, with a large amount of user data and high-level talent.

Beyond the technical field, many traditional corporate giants have gained a lot from IoT and have many concerns. This may be an opportunity to rethink all the issues. IoT will shift big companies from a product-centric model to a service-centric model. In the world of IoT, large companies can intuitively understand how customers use their products; they will be able to customize products and services according to their needs; they will be able to predict when products will fail and need support; they also have the opportunity to use and develop Subscribe models and direct long-term relationships to control customers. The impact of these changes will be enormous. On the other hand, the threat is also great – for example, how will the auto industry change as unmanned vehicles become a reality? Will the old auto company be degraded as a parts supplier?

The opportunity for these companies to thrive in the IoT world lies in their ability to transform into a software company. Some traditional industrial companies already have their own software teams—for example, how Bosch Software InnovaTIon or General Electric recruited hundreds of software engineers in Silicon Valley. So this is not an impossible task - many companies will stick to it.

What does this mean for start-ups? Of course, interest from big companies has led to many acquisition opportunities. Big technology companies have already undergone a fierce acquisition process, and large traditional companies need to transform into software companies through acquisitions. On the other hand, for start-ups trying to stick to their own development, the road to development will become narrower and require flexible strategies. Big companies will certainly not build every single connected product, but they will also take the lead in occupying large market space. Or, they will be willing to hire top talent at high salaries – a few months ago, Uber hired 40 robotic developers from Carnegie Mellon to study driverlessness. For young start-ups, the road to success must be to avoid the big companies' markets and work with big companies to participate in their manufacturing and distribution processes.

in conclusion

The era of IoT is coming soon. Despite the many difficulties, as shown in our territory, startups and large companies around the world are actively working to make the world of IoT inevitable. The progress of IoT seems slow, but when a person stops to think about the changes needed in the connected world, IoT will develop very quickly. Many scenes that look like science fiction for 10 years are now a reality, and we are beginning to get closer to the scenes surrounded by connected objects, drones and unmanned vehicles. The bigger question is whether our society is ready for such a change.

Spo2 Sensor Cable,Pulse Oximeter Cable,SpO2 Cables and Sensors,Pediatric SpO2 Sensor Cable

Dong guan Sum Wai Electronic Co,. Ltd. , https://www.sw-cables.com

![<?echo $_SERVER['SERVER_NAME'];?>](/template/twentyseventeen/skin/images/header.jpg)